Over the summer I had the opportunity to intern with ImpactAssets, a nonprofit financial services firm focused on impact investing. Prior to my internship, I understood the theoretical underpinnings of how impact investing worked, but had no practical experience in the sector and thus began my experience with a long list of questions.

My background is in financial services. Prior to Presidio, I worked for a financial services firm that catered to hedge funds, working closely with fund managers and traders as I supported their everyday operations. I had seen first-hand the incredible power of markets, both the benefits of this power and its negative, often unintended consequences. It was during this time that I realized I wanted to work for an organization that focused its strategies not only on creating financial value, but also on leveraging capital to address systemic environmental and social issues. So began my interest in impact investing. ImpactAssets’ mission is to increase the flow of capital into impact investing. The firm manages a highly-regarded donor advised fund (DAF), which serves, in a sense, as an outsourced foundation. Foundations are costly to administer and take considerable time to set up and manage, so an individual, family or small institution may set up a DAF to more easily manage and disburse charitable donations. In the case of ImpactAssets, high net worth individuals or families deposit funds into the DAF, receive an immediate tax benefit, and then have a range of impact investment options to choose from while they decide how to grant those funds.

During my internship I had the opportunity to see first-hand how impact investing is put into practice. This included investment processes like being involved in new product development, as well as the due diligence process. I also worked on the “field building” side of impact investing by drafting an issue brief on millennial investors. While I had the opportunity to work on a variety of projects during my time over the summer, there were two key takeaways that deepened and broadened my overall understanding of what impact investing is in practice.

The distinction of different kinds of investment decisions

Investing and return objectives ultimately sit along a spectrum from pure charity (philanthropic donations) to pure profit (what we think of as traditional investing). Between these two extremes exist key tools such as venture philanthropy; program related investments (PRI); impact investing; environmental, social, governance (ESG) investing; and socially responsible investing (SRI). While I was familiar with each of these terms, I quickly learned that I had heard and used some of these key labels to describe aspects of investing interchangeably when in fact there are clear, crucial distinctions.

SRI and ESG investing fall on the side of the spectrum that utilizes positive or negative screens in making investment decisions, following more of a limiting or restricting philosophy. In other words, not investing in vice companies like those that produce tobacco products and primarily investing in publicly traded companies that meet certain social or environmental criteria. Venture philanthropy and PRIs fall on the social side of the spectrum, seeking little to no financial return and but substantial social return. Impact investing is the nexus of these two spectrums, joining financial and social returns by investing in social enterprises to create social and financial value.

The different players in the impact investing space: the investor, the fund, the intermediary, and the social enterprise

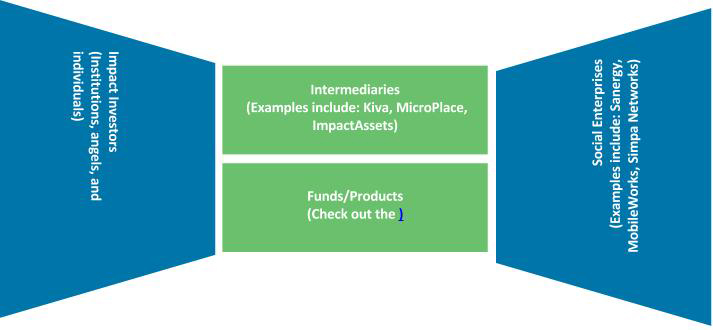

There are multiple players in the impact investing space, with each playing a distinct role. Learning and understanding who the players are and how they work gives you the ability to not only understand the theory, but see how it is put into practice. There are four key players in the impact investing space: the investors, the funds, the intermediaries, and the social enterprises. The players and where they fit in can be viewed in the following way:

• The impact investor is the institution, individual, or angel that has the funds to distribute

• The intermediary acts as a facilitator, connecting investors to social enterprises

• The fund uses money from investors to invest across a portfolio of social enterprises or initiatives

• The social enterprise is a for-profit venture aimed at creating social and/or environmental value with their product

Source: Adapted from Fran Seegull, ImpactAssets

My experience this summer broadened and deepened not only my understanding of impact investing, but also my appreciation and excitement for the field. Working with ImpactAssets solidified for me that I want to work in the impact investing space in the future, and I look forward to spending the second year of my MBA focused on advancing that aim.